FROM ARM’S LENGTH TO VALUE CREATION TO MARKETS

Guest Lecturer:

Stef van Weeghel

Global Tax Policy Leader, PwC

Professor of International Tax Law, University of Amsterdam

Lectureship Dates | Registration Fees | Schedule | Speaker Bio | Accreditation

The 2020 IFA Travelling Lecture will be delivered by Stef van Weeghel, professor of international tax law at the University of Amsterdam and Global Tax Policy leader at PwC.

His lecture will focus on the evolution of international profit allocation with a heavy focus on the current OECD/IF project “Tax challenges arising from digitalization”. By February 2020, the features of the future architecture of the international tax system are likely to be more visible following the release of the program of work in June 2019 and of the ‘Secretariat Proposal for a “Unified Approach” under Pillar One’ on October 9, 2019.

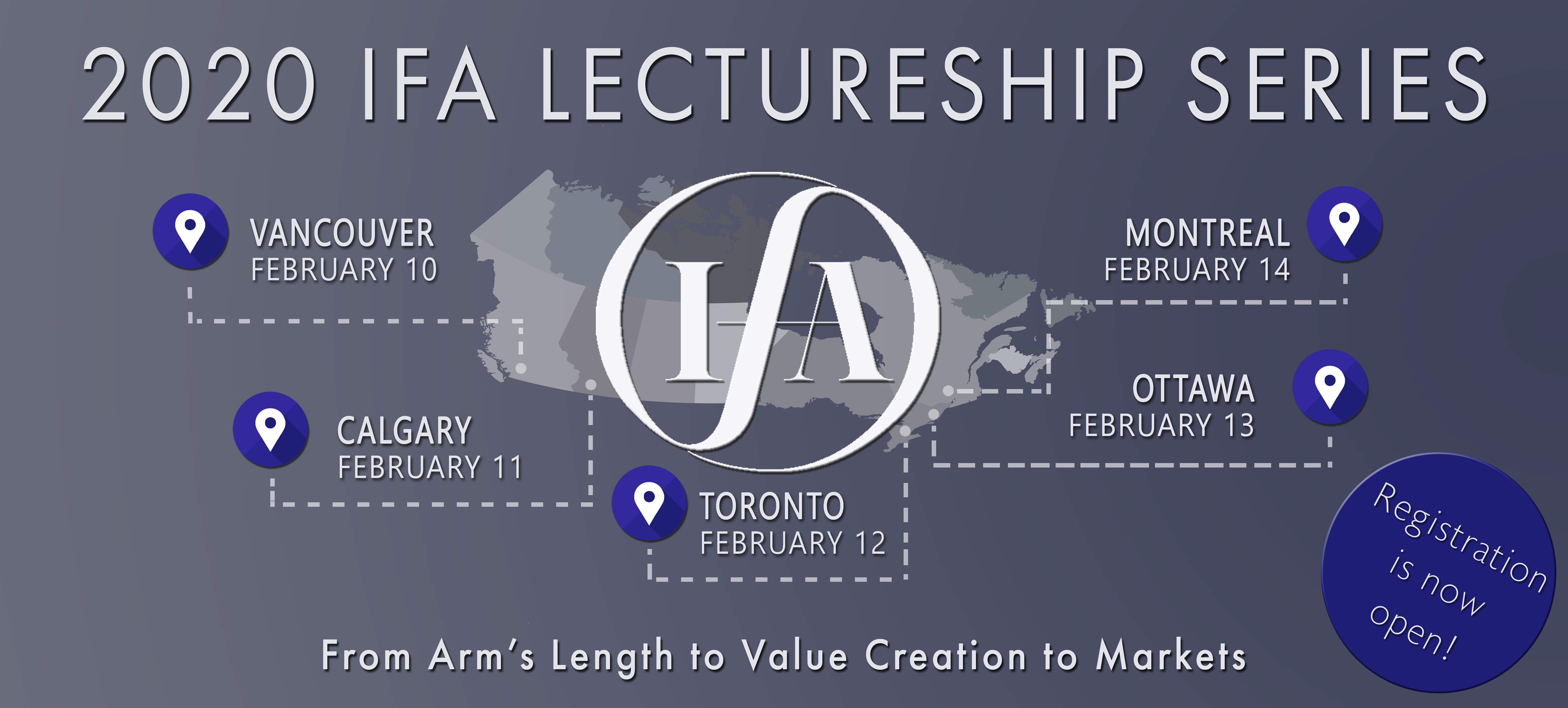

Schedule | Vancouver, Calgary, Toronto, Ottawa, Montreal |

|

7:30 AM – 8:30 AM |

Registration and Breakfast |

8:30 AM – 12:30 PM |

Lectureship: From Arm’s Length to Value Creation to Markets |

Email IFACanada@ctf.ca with any questions

| Registration Fees |

|||

| Provincial taxes apply to the listed registration fees | |||

| Member | Non-Member | Registration + Membership Special 1 | |

| Regular Régulier |

$190 |

$275 | $290 |

| Prof./Govt Prof./Gouv |

$60 |

$90 | $150 |

| Young Member 2 Jeune membre |

$60 |

$90 | $150 |

| Student Étudiant |

$10 | $25 | $80 |

1Special: Registration + 2020 IFA membership / Spéciale: Inscription + adhésion 2020 de l’IFA |

|||

| 2 YM/JM: Young Members are those 29 and under on January 1, 2020. New members, please provide your date of birth to IFACanada@ctf.ca |

|||

| 1,2 Special Offers valid for new members only / Offre spéciale valuable pour les nouveaux membres seulement | |||

| Membership: You can view membership rates or renew your membership by downloading the PDF registration form, or online by clicking here. | |||

Provincial tax rates

British Columbia: 5% GST Quebec: 9.975% QST and 5% GST Ontario: 13% HST |

|||

ACCREDITATION

|

ALBERTA: For Alberta lawyers, consider including this course as a CPD learning activity in your mandatory annual Continuing Professional Development Plan as required by the Law Society of Alberta. |

The Law Society of Alberta does not accredit courses offered by CLE providers nor assign hours to a course. It is the decision of each lawyer whether a CPD course or activity meets the requirements of Rule 67.1 and whether to include it in their CPD Plan. |

BRITISH COLUMBIA: This program has been approved by the Law Society of British Columbia for up to 3.5 CPD credits. |

| At the conclusion of the lectureship, you can click here to log-in to the Law Society of British Columbia’s website to register your credits. This program is listed under the name ‘IFA Lectureship: From Arm’s Length to Value Creation to Markets’. |

ONTARIO: This program is eligible for up to 3.5 Substantive Hours. |

| According to the Law Society of Ontario, substantive hours may address substantive or procedural law topics and/or law related subjects that are relevant to the lawyer’s or paralegal’s practice and professional development. |

QUEBEC: This program is pending approval by the Barreau du Québec for a total of 3.5 hours.

|