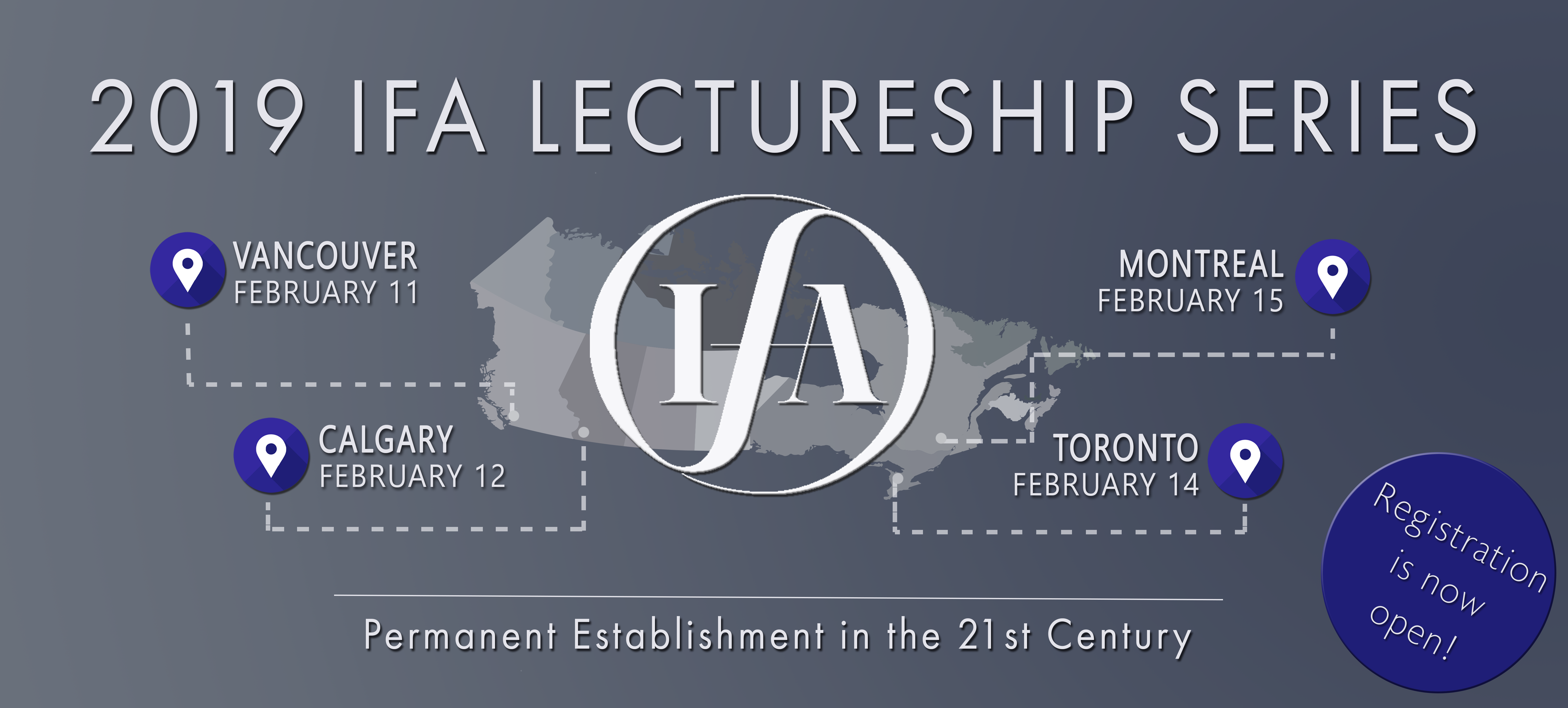

Permanent Establishment in the 21st Century

Guest Lecturer:

Jonathan Schwarz BA, LLB (Witwatersrand), LLM (UC Berkeley), FTII

Temple Tax Chambers, London, UK

Lectureship Dates | Registration Fees | Schedule | Speaker Bio

Online registration is now closed.

Please contact ifacanada@ctf.ca with any questions!

Meaning of PE

The definition of permanent establishment in tax treaties has undergone the most significant change in its more than 100-year history. This seminar examines the new definitions in the OECD and UN model treaties, the impact of the BEPS MLI on treaty practice and their implications for cross-border business.

The 2017 OECD Commentary to the model treaty incorporates the 25 issues examined in the pre-BEPS consultation on the meaning of permanent establishment. The utility of the revamped Commentary will be analysed.

Recent case law around the world will be discussed to indicate both administrative and judicial approaches to existing treaty definitions.

Attribution of profits

The Authorised OECD Approach to attribution of permanent establishment profits is now in its 10th year of adoption. The seminar will examine treaty practice in relation to the AOA, the 2010 revised OECD model article 7 and recent case law on profit attribution as well as OECD work post-BEPS on this issue.

Unilateral measures

Unilateral approaches as exemplified by the UK diverted profits tax will be discussed.

Schedule | Vancouver, Calgary, Toronto |

|

7:30 AM – 8:30 AM |

Registration and Breakfast |

8:30 AM – 12:30 PM |

Lectureship: Permanent Establishment in the 21st Century |

Schedule | Montreal |

|

9:30 AM – 10:00 AM |

Registration |

10:00 AM – 2:30 PM |

Lectureship: Permanent Establishment in the 21st Century |

Email IFACanada@ctf.ca with any questions

| Registration Fees |

|||

| Provincial taxes apply to the listed registration fees | |||

| Member | Non-Member | Registration + Membership Special 1 | |

| Regular Régulier |

$190 |

$275 | $290 |

| Prof./Govt Prof./Gouv |

$60 |

$90 | $150 |

| Young Member 2 Jeune membre |

$60 |

$90 | $150 |

|

Student |

$10 | $25 | $80 |

|

|

|||

|

2 YM/JM: Young Members are those 29 and under on January 1, 2019. New members, please provide your date of birth to IFACanada@ctf.ca

|

|||

|

1,2 Special Offers valid for new members only / Offre spéciale valuable pour les nouveaux membres seulement |

|||

|

Membership: You can view membership rates or renew your membership by downloading the PDF registration form, or online by clicking here.

|

|||

|

British Columbia: 5% GST Quebec: 9.975% QST and 5% GST Ontario: 13% HST |

|||