IFA Canada’s International Tax Conference will be coming back to Montreal in 2019!

CONFERENCE CO-CHAIRS:

Derek Chiasson, Norton Rose Fulbright, Montreal

Marie-Emmanuelle Vaillancourt, Davies Ward Phillips & Vineberg LLP, Montreal

Your conference materials are out now!

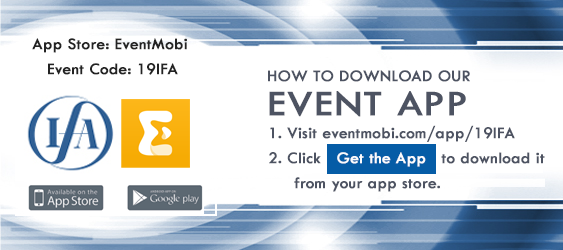

View them on the IFA Canada Website and on the IFA Conference App

| Agenda – Tuesday, May 14, 2019 |

|||||||||||||||

7:30am |

Breakfast | Registration Desk Opens |

||||||||||||||

| Pre-Conference Session |

|||||||||||||||

| 8:25am | YIN Welcome | ||||||||||||||

| 8:30am | YIN In-Depth

Back-to-Back Loan Rules Presentation on the various Canadian “back-to-back” loans rules, including the rules applicable to Part XIII tax, shareholder loans, upstream loans and thin capitalization. The presenters will also provide practical examples of the application of these rules. |

||||||||||||||

|

Moderator: YIN Rapporteur: Presenters: |

Marc André Gaudreau Duval, Davies Ward Phillips & Vineberg LLP, Montreal

Sara-Michelle Marcotte-Genier, PwC LLP, Montreal Mathieu Champagne, Deloitte LLP, Montreal Simon Lamarche, PwC Canada, Montreal Designed for Young Members but all are welcome |

||||||||||||||

9:40am |

Conference Registration |

||||||||||||||

| 9:50am | Conference Welcome & Opening Remarks |

||||||||||||||

10:00am |

Cross-Border Financing The panelists will provide insights into recent developments affecting cross-border financing. After a brief history of Canada- US financing structures, the panelists will discuss the impact of US tax reform on financing of US subsidiaries, including the proposed anti-hybrid regulations, some restructuring considerations and potential options going forward. The panel will also cover recent non-US developments affecting cross-border financing, in particular in the EU.

|

||||||||||||||

|

Moderator: YIN Rapporteur: Presenters: |

Marie Blanchard, SNC Lavalin Group Inc., Montréal

Reuben Abitbol, Davies Ward Phillips & Vineberg LLP, Montreal Pierre Bourgeois, Raymond Chabot Grant Thornton LLP, Montréal Jim Samuel, KPMG LLP, Calgary Paul Seraganian, Osler, Hoskin & Harcourt LLP, New York Louis Thomas, KPMG LLP, Luxembourg |

||||||||||||||

11:15am |

Refreshment Break Sponsored by: |

||||||||||||||

|

|

International Exchange of Information

This panel will discuss the status and direction of such tools and mechanisms, including: • Recent changes in CRA’s International and Large Business Directorate; |

||||||||||||||

|

Moderator: YIN Rapporteur: Presenters: |

Lynn Moen, LM Consulting, Calgary Ata Kassaian, Innocap, Montreal Sue Murray, Canada Revenue Agency, Ottawa Sébastien Rheault, Barsalou Lawson Rheault, Montreal |

||||||||||||||

| 12:15pm | Luncheon

|

||||||||||||||

2:00pm |

Recent Canadian Developments This session will cover: • Recent legislative developments, including Budget 2019 Sponsored by:

|

||||||||||||||

|

Moderator: YIN Rapporteur: Presenters: |

Elaine Marchand, National Bank , Montreal

Romy-Alexandra Laliberte, Deloitte Tax Law, Montreal Natalie Goulard, Department of Justice, Montreal Nathalie Goyette, Davies Ward Phillips & Vineberg LLP, Montreal Angelo Nikolakakis, EY LLP, Montreal Christopher Steeves, Fasken, Toronto |

||||||||||||||

3:30pm |

Refreshment Break Sponsored by:

|

||||||||||||||

3:45pm |

MLI Implementation and OECD Developments The panelists will cover two broad topics: (i) MLI implementation and; (ii) taxation of the digital economy. The panel discussion will include an OECD and Department of Finance update, a review of developments at the EU level, in France and in select other European countries, and interaction between the panelists in respect of some of the practical issues raised by the PPT test in the MLI.

|

||||||||||||||

|

Moderator: YIN Rapporteur: Presenters: |

Michael Kandev, Davies Ward Phillips & Vineberg LLP, Montreal Ana Mata Zapico, SNC-Lavalin, Montreal Sophie Chatel, Head of the Tax Treaty Unit in the Centre for Tax Policy and Administration, OECD Mark Dumalski, Deloitte LLP, Ottawa Julien Gayral, Bredin Pratt, France, Paris Stephanie Smith, Department of Finance, Ottawa |

||||||||||||||

| 5:00pm | Adjournment |

||||||||||||||

| 5:30pm | Cocktail Reception

1155 Sherbrooke Ouest | Get Directions |

||||||||||||||

| 6:30pm | Dinner

Sofitel Montréal Golden Mile Hotel 1155 Sherbrooke Ouest | Get Directions Sponsored by:

|

||||||||||||||

| 9:00pm | YIN After Party AIR Rooftop Terrace | Air Espace Terrasse Join us for the YIN afterparty being held at the AIR Rooftop Terrace, a stylish restaurant, bar and lounge high above Montreal. Network on the outdoor terrace with the city as your backdrop.

|

||||||||||||||

| Agenda – Wednesday, May 15, 2019 |

|||||||||||||||

| 7:30am |

Registration & Breakfast |

||||||||||||||

| 8:15am | IFA Canada Annual General Meeting | ||||||||||||||

| 8:30am | IFA 2019 Congress Reports | ||||||||||||||

|

Subject 1: |

Interest Deductibility: The Implementation of BEPS Action 4 | ||||||||||||||

|

National Reporter: |

Amanda Heale, Osler, Hoskin & Harcourt LLP, Toronto | ||||||||||||||

|

Subject 2: |

Investment Funds |

||||||||||||||

|

National |

Patrick Bilodeau, Deloitte LLP, Ottawa | ||||||||||||||

9:00am |

Tax Directors’ Roundtable: Pressing Topics from the Front Lines In-house tax professionals will discuss the issues that are foremost for their enterprises such as current audit issues, matters related to international structuring and how they are responding to the changing international environment. Sponsored by:

|

||||||||||||||

|

Moderator: YIN Rapporteur: Presenters: |

Brian Mustard, BCE Inc., Montreal

Ilia Korkh, EY LLP, Vancouver Patrick Bertrand, Pratt & Whitney Canada, Longueuil Christine Couture, Alimentation Couche-Tard Inc., Laval |

||||||||||||||

| 9:45am | Refreshment Break

Sponsored by:

|

||||||||||||||

10:00am |

Structuring of Cross-Border M&A The panelists will provide an overview of salient Canadian income tax considerations relevant to inbound (into Canada) acquisition and financing structuring. The first part of the presentation will outline a form of inbound structuring checklist with a focus on select topics. The second part of the presentation will provide some insight on select recent Canadian developments affecting inbound structuring. The final portion of the presentation will provide a brief outline on select global developments that are rapidly evolving that impact cross-border structuring including in the M&A context. Sponsored by: |

||||||||||||||

|

Moderator: YIN Rapporteur: Presenters: |

Véronique Fauteux, Dorel Industries, Montreal

Rémi Gagnon, McCarthy Tétrault LLP, Montreal John Leopardi, Blake, Cassels & Graydon LLP, Montreal Eric Lévesque, Stikeman Elliott LLP, Montreal Christian Meighen, McCarthy Tétrault LLP, Montreal |

||||||||||||||

11:00am |

Transfer Pricing Digital taxes: it’s not just about technology companies? The panelists will discuss the background and provide insights into global digital tax proposals , potential impacts and challenges. They will also look into how US tax reform from a transfer pricing perspective is fuelling the debate. |

||||||||||||||

|

Moderator: YIN Rapporteur: Presenters: |

Katherine Kam, SNC-Lavalin Group Inc., Montreal

Bhuvana Sankaranarayanan, Borden Ladner Gervais LLP, Ottawa Hernan Allik, Deloitte LLP, Montreal Emma Purdy, PwC Canada, Toronto Scott Wilkie, Blake, Cassels & Graydon LLP, Toronto |

||||||||||||||

12:00pm |

Buffet Lunch Sponsored by:

|

||||||||||||||

1:00pm |

Select U.S. Legislative & Case Law Developments US Tax Reform – Who Comes Out On Top? • Case studies on Canada-US cross-border investments to illustrate the principal effects of US tax reform. |

||||||||||||||

|

Moderator: YIN Rapporteur: Presenters: |

Patrick Marley, Osler, Hoskin & Harcourt LLP, Toronto

Robert Lee, Felesky Flynn LLP, Calgary |

||||||||||||||

| 2:00pm | Finance Roundtable | ||||||||||||||

|

Moderators: YIN Rapporteur: Presenters: |

Jonathan Greb, Baytex Energy Corp., Calgary

Claire Kennedy, Bennett Jones LLP, Toronto Emily Gilmour, Osler, Hoskin & Harcourt LLP, Toronto Ted Cook, Director General, Tax Legislation Division, Department of Finance Canada, Ottawa Stephanie Smith, Senior Director, Tax Treaties, Finance Canada, Ottawa |

||||||||||||||

| 2:45pm | Refreshment Break | ||||||||||||||

| 3:00pm | CRA Roundtable | ||||||||||||||

| Moderators:

Presenters: |

Kim Maguire, Borden Ladner Gervais LLP, Vancouver

Carrie Smit, Goodmans LLP, Toronto Yves Grondin, Canada Revenue Agency, Ottawa Yves Moreno, Canada Revenue Agency, Ottawa |

||||||||||||||

| 4:00pm | Adjournment | ||||||||||||||

|

|||||||||||||||

| ADDITIONAL REGISTRATION OPTIONS | ||||||||

| Binder (Electronic materials will be available to all attendees via the App) |

$50 | |||||||

| Additional Dinner Tickets (We must have guest names in advance) |

$75 | |||||||

ACCREDITATION |

| »Request an attendance letter |

ALBERTA: For Alberta lawyers, consider including this course as a CPD learning activity in your mandatory annual Continuing Professional Development Plan as required by the Law Society of Alberta. The Law Society of Alberta does not accredit courses offered by CLE providers nor assign hours to a course. It is the decision of each lawyer whether a CPD course or activity meets the requirements of Rule 67.1 and whether to include it in their CPD Plan. |

BRITISH COLUMBIA: This program has been approved by the Law Society of British Columbia for up to 11 CPD credits. At the conclusion of the conference, you can click here to log-in to the Law Society of British Columbia’s website to register your credits. This program is listed under the name ‘2019 IFA International Tax Conference’. |

MANITOBA: This program may be reported for up to 11 hours of eligible CPD activity. The Law Society of Manitoba does not accredit providers, but will have the discretion to determine that activities offered by a specific provider are not eligible activities if they do not adequately promote competent practice. It is up to the lawyer to determine if the activity is an eligible CPD activity. |

ONTARIO: This program is eligible for up to 11 Substantive Hours. According to the Law Society of Ontario, substantive hours may address substantive or procedural law topics and/or law related subjects that are relevant to the lawyer’s or paralegal’s practice and professional development. |

QUEBEC: This program has been approved and recognized by the Barreau du Québec for a total of 11 hours. |

SASKATCHEWAN: This program has been approved by the Law Society of Saskatchewan for up to 11 CPD hours. |

| Lawyers are required to self-report their CPD activities in their Member Profile through the Law Society’s website. |

| Accommodations | ||

|

IFA Canada has reserved a small block of rooms at the Sofitel Montreal Golden Mile Hotel for out-of-town registrants and locals wishing to stay at the conference site. Please be sure to ask for the International Fiscal Association rate and book before Friday, April 12, 2019. Delegates should make their own hotel arrangements by phone or email, referencing the IFA rate. |

||

Toll Free 1-877-285-9001

|

||

h3646-op@sofitel.com |

| Sofitel Montreal Golden Mile Sofitel Montréal Le Carré Doré 1155 Sherbrooke St W, Montreal, QC H3A 2N3 |

Get Directions |

|

|

|

| RATE | ||

| Single/Double | ||

| $265 | ||

| Available Nights: May 13 & May 14, 2019 | ||

| Quote the International Fiscal Association Rate |