Taking place in-person in Toronto.

Streaming live simultaneously from offices in Vancouver, Calgary, Ottawa and Montreal.

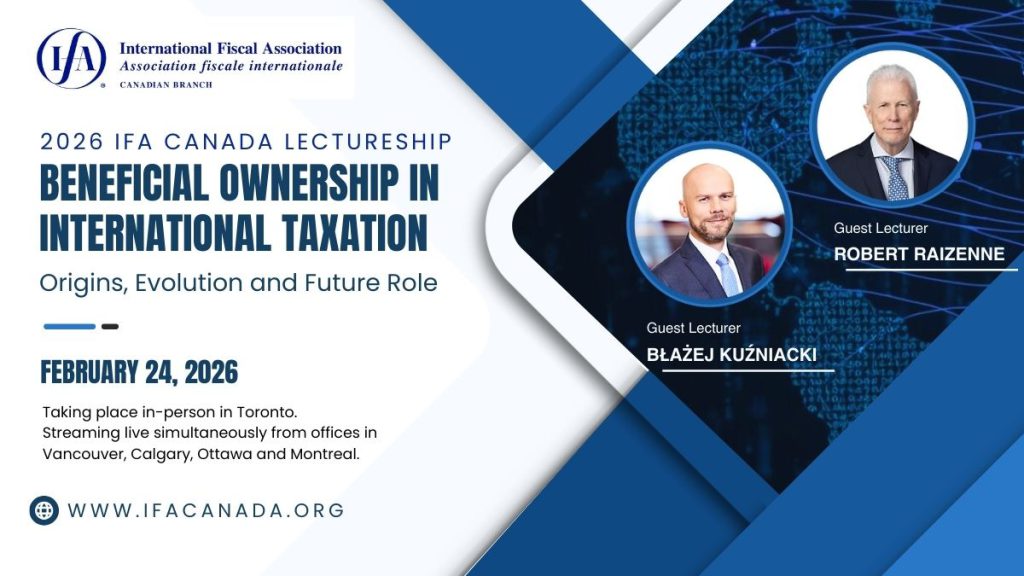

Lectureship Overview

Beneficial ownership is a fundamental concept in determining a taxpayer’s entitlement to tax treaty benefits. Longstanding jurisprudence in Canada has recently been reconsidered by the Federal Court of Appeal in Canada. Speakers Błażej Kuźniacki and Robert Raizenne will discuss the elaboration and historical development of the beneficial ownership concept and the role the concept currently plays in international taxation. The scope of beneficial ownership as defined in sometimes conflicting international jurisprudence and the parameters set by the OECD will be discussed. The speakers will also comment on its future role in a changing international taxation landscape, addressing continuing uncertainty in this area.

This lectureship will be delivered live and in person in Toronto on Tuesday, February 24.

In addition, satellite viewing events will take place in Vancouver, Calgary, Ottawa, and Montreal, where attendees will watch the live lecture together in a meeting space and be able to participate in the live Q&A.

There is no individual or at-home webcast option.

TORONTO

11:00 AM – 2:45 PM EST

Offices of Gowling WLG

100 King St W Suite 1600

Toronto, ON M5X 1G5

VANCOUVER

8:00 AM – 11:45 PM PST

Venue will be announced

CALGARY

9:00 AM – 12:45 PM MST

Venue will be announced

OTTAWA

11:00 AM – 2:45 PM EST

Venue will be announced

MONTREAL

11:00 AM – 2:45 PM EST

Venue will be announced

Program Agenda (PST / MST / EST)

8:00 am PST | 9:00 am MST | 11:00 am EST

Registration / Check-in

8:15 am PST | 9:15 am MST | 11:15 am EST

Lectureship

11:45 am PST | 12:45 pm MST | 2:45 pm EST

Adjournment

Błażej Kuźniacki, Global Tax Policy & International Tax Services at PwC Netherlands | Professor of Law at Lazarski University | Senior Research Affiliate at Singapore Management University

Błażej Kuźniacki is a tax practitioner with qualification as an attorney-at-law (Warsaw Bar Association), currently working at PwC Netherlands (Amsterdam office) with International Tax Services Team and the PwC Global Tax Policy Team. Błażej provides a strategic tax advice on international tax law and global tax policy. He also is the award-winning author of more than 150 scientific publications with national and global coverage, including four books. For the book “Beneficial Ownership in International Taxation” (2022), Błażej was awarded with the International Fiscal Association (IFA) Mitchell B. Carroll Prize in 2023.

Many authoritative sources, e.g. apex courts in Brazil, Poland and Switzerland, the OECD, the WBG, and the CIAT cite Błażej’s work to support their reasoning in jurisprudential and tax policy pieces. He speaks frequently on international tax law, investment tax related disputes and tax XAI (eXplainable AI) next to his practice in these fields, including expert witness’s opinions.

Robert Raizenne, Tax Partner, Osler, Hoskin & Harcourt LLP, Adjunct Professor of Tax Law at McGill University’s Faculty of Law, and the Faculty of Law at the University of Toronto

Robert Raizenne has extensive experience in a wide variety of transactions and tax planning matters, including cross-border and domestic mergers and acquisitions, corporate reorganizations and restructurings, corporate finance, international tax and trusts. He is also an experienced tax litigator.

Robert is an adjunct professor of tax law at McGill University’s Faculty of Law and the Faculty of Law at the University of Toronto, and a sought-after speaker and writer on tax topics. He has spoken frequently at the Canadian Tax Foundation’s Annual Conference, the Annual Conference of the Canadian Branch of the International Fiscal Association and many other professional venues.

Regular Member – $165

Young Member – $55

Academic Member – $55

Student – $10

Provincial Sales Tax will apply to registration fees at checkout.

Government (IFA Member or Non-Member) – $90

This rate is for employees of recognized government institutions. Validation may be required.

Provincial Sales Tax will apply to registration fees at checkout.

Non-Member – $220

Young* – $75

Academic** – $75

Student*** – $10

Special Offer – Membership + Registration – $275

Special Offer – Young Membership + Registration – $120

Special Offer – Academic Membership + Registration – $120

IMPORTANT NOTES

Provincial Sales Tax will apply to registration fees at checkout.

Special Offer Details: IFA Membership for the 2026 year and in-person registration to the conference at a discounted rate. Applies to new members only.

Special Offer Young membership: Must be under 30 years of age as of January 1st, 2026. Applies to new members only.

Other Notes:

* Young Non-Member: DOB must be provided at check-out. Those under 30 years of age as of January 1, 2026, qualify.

** Full-time academics are professors with a valid email address from a recognized institution only.

*** Students must be full-time and need an email address from a recognized educational institution. Articling students and those already working in their profession do not qualify. Further proof may be required.

© International Fiscal Association (Canadian Branch) 2021. All rights reserved.