The Multilateral Instrument and Canada’s Tax Treaties

Lecturer:

David G. Duff, Professor and Director LLM in Taxation Program

Peter A. Allard School of Law | The University of British Columbia

Lectureship Dates | Registration Fees | Schedule

The signature of the Multilateral Convention to Implement Tax Treaty Measures to Prevent Base Erosion and Profit Shifting (the MLI) has been described as “an historical turning point in the area of international taxation” which introduces a third layer of tax rules for the taxation of cross-border transactions in addition to domestic tax law and bilateral tax treaties.

This lecture will provide a comprehensive overview of:

• the MLI and its implications for international taxation in Canada

• reviewing the origins of the MLI in the OECD’s base erosion and profit shifting (BEPS) project

• the general structure and mechanics of the MLI

• key substantive provisions of the MLI (particularly the minimum standards on treaty abuse in Articles 6 and 7)

• the impact of the MLI on Canada’s bilateral tax treaties

• the possible future of the MLI and its relationship to the OECD Model Convention and Commentaries.

Schedule |

|

7:30 AM – 8:30 AM |

Registration and Breakfast |

8:30 AM – 12:30 PM |

Lectureship: The Multilateral Instrument and Canada’s Tax Treaties |

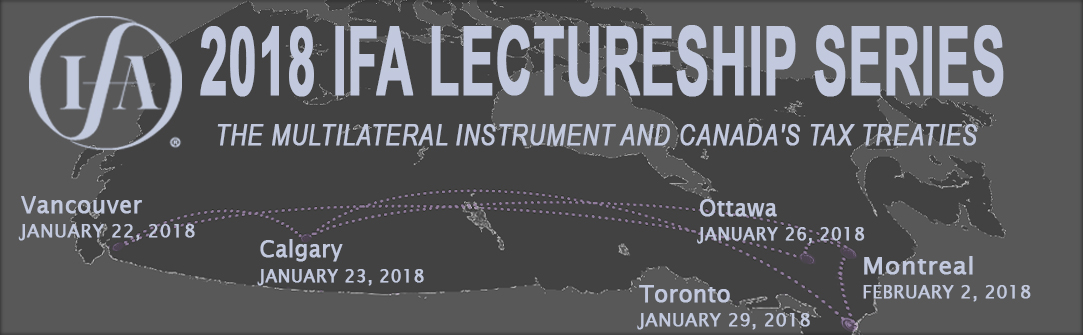

Nationwide Lectureship Dates |

|||

VANCOUVER |

Monday, January 22, 2018 |

| Save the Date |

Pan Pacific Vancouver 300 – 999 Canada Place, Vancouver V6C 3B5 |

CALGARY |

Tuesday, January 23, 2018 |

| Save the Date |

Calgary Marriott Downtown Hotel 110 9th Avenue SE, Calgary T5G 5A6 |

OTTAWA |

Friday, January 26, 2018 |

| Save the Date |

Sheraton Ottawa Hotel 150 Albert Street, Ottawa K1P 5G2 |

TORONTO |

Monday, January 29, 2018 |

| Save the Date | Pantages Hotel Downtown Toronto 200 Victoria Street, Toronto M5B 1V8 |

MONTREAL |

Friday, February 2, 2018 |

| Save the Date | Hyatt Regency Montreal 1255 Jeanne-Mance Street, Montreal H5B 1E5 |

Email IFACanada@ctf.ca with any questions

| Registration Fees |

|||

| Provincial taxes apply to the listed registration fees | |||

| Member | Non-Member | Registration + Membership Special 1 | |

| Regular Régulier |

$190 |

$275 | $290 |

| Prof./Govt Prof./Gouv |

$60 |

$90 | $150 |

| Young Member 2 Jeune membre |

$60 |

$90 | $150 |

|

Student |

$10 | $25 | $80 |

|

|

|||

|

2 YM/JM: Young Members are those 29 and under on January 1, 2018. New members, please provide your date of birth to IFACanada@ctf.ca

|

|||

|

1,2 Special Offers valid for new members only / Offre spéciale valuable pour les nouveaux membres seulement |

|||

|

Membership: You can view membership rates or renew your membership by downloading the PDF registration form, or online by clicking here.

|

|||

|

British Columbia: 5% GST Quebec: 9.975% QST and 5% GST Ontario: 13% HST |

|||